6 Ways to Fund Your Startup Without Giving Up Equity

One of the biggest myths in startups is that venture capital is the default funding path.

The reality? Most startups never raise VC money.

Less than 1% of UK startups secure venture capital funding. (British Business Bank)

80% of UK small businesses rely on personal savings or loans from family and friends. (Startups.co.uk)

Nearly 60% of UK startups fail within their first three years, often due to running out of cash. (Nerdwallet UK)

Before founders even get in the room with investors, they typically fund their businesses through scrappy, alternative methods. If you’re in the early days and wondering how to get your startup off the ground, here’s where most founders actually get their first funding.

1. Bootstrapping: Your Money, Your Rules

The #1 investor in most startups? The founder.

Bootstrapping means using personal savings, credit cards, and revenue to fund growth. It gives you full control but also comes with risk—if the business fails, you absorb the losses.

🚀 Why it works:

Full ownership—no outside pressure from investors.

Forces efficiency—every dollar is spent wisely.

You build traction before needing outside funding.

⚠️ Downsides:

Financial risk—draining savings or accumulating debt.

Slower growth—limited funds mean limited speed.

Stat: 64% of entrepreneurs fund their startups with personal savings (SBA).

Some of the biggest companies—Mailchimp, Basecamp, Spanx—were bootstrapped for years before raising (or never raised at all).

2. Friends & Family: The First True Investors

After personal savings, the next major funding source is friends, family, and close connections.

Many founders borrow money, raise small “love rounds,” or ask for early support from people who believe in them.

🔹 Why it works:

Fewer formalities—faster access to funds.

Investors who trust you, not just your numbers.

Can be structured as a simple loan or equity.

⚠️ Risks:

Mixing money with relationships can be tricky—what happens if the startup fails?

Some founders feel pressure to succeed because their close circle is invested.

Stat: 38% of startups receive initial funding from family and friends (Kauffman Foundation).

Pro Tip: Always document the terms clearly (even with family) to avoid future conflicts.

3. Grants & Competitions: Free Money, No Equity

Startups in tech, sustainability, AI, and innovation can access government grants, research funding, and startup competitions.

💰 Sources of non-dilutive funding in the UK:

Innovate UK Grants (£1 billion in funding available annually) - currently on pause

The Prince’s Trust Grants (for young entrepreneurs)

Smart Grants for Innovative Startups (£25K-£2M for early-stage ideas)

Scottish EDGE Grants (for Scotland-based startups)

🚀 Why it works:

No equity dilution—you keep 100% of your company.

Adds credibility—winning a grant can attract investors later.

⚠️ Downsides:

Competitive—everyone wants “free money.”

Applications can be time-consuming and slow.

Stat: Innovate UK has awarded over £8 billion in grants to startups since its inception.

4. Revenue: The Most Underrated Funding Source

Instead of raising money—what if your customers funded your startup?

Pre-sales, subscriptions, and service-based revenue can all be used to fund product development. Some of the biggest companies today started by offering consulting, workshops, or early access discounts before building their full product.

🚀 Why it works:

Immediate validation—real paying customers.

Keeps you lean and focused.

No debt, no dilution.

⚠️ Downsides:

May require pivoting early based on revenue opportunities.

Can be slow to scale if capital-intensive.

Stat: 29% of startups fail because they run out of cash—early revenue can prevent this (CB Insights).

Many founders assume they need funding first—but in reality, funding follows traction.

5. Angel Investors: The First Outside Check

When bootstrapping and personal networks aren’t enough, angel investors are often the first real external funding source.

These are typically successful entrepreneurs, industry experts, or high-net-worth individuals who invest their own money in early-stage startups.

💰 Why angels invest:

Higher risk tolerance than VC firms.

They invest in founders, not just financials.

Can offer mentorship and connections.

⚠️ Risks:

Angels invest small amounts ($10K–$250K per check).

Can take time to find the right investor fit.

Stat: UK angel investors invested £1.3 billion in startups in 2023. (UKBAA)

6. Venture Capital: The Path Less Taken

Most people overestimate how many startups raise VC money.

The truth? Less than 1% of startups successfully raise VC.

💡 What VCs look for:

Scalable business models with high growth potential.

Market size worth at least £100M+.

Founders with proven execution skills.

🚨 Why VC isn’t always the answer:

Dilution—you give up ownership.

Pressure to scale fast—some companies get forced into unsustainable growth.

Not all businesses fit the VC model—many great companies don’t need it.

Stat: 75% of VC-backed startups fail—raising money doesn’t guarantee success (Harvard Business Review).

VC can be game-changing—but for the right type of startup at the right time.

Final Thought: Funding Follows Traction

Most UK startups don’t get VC funding—and they don’t need it.

Your first funding will likely come from:

Your own savings

Friends & family

Customers

Grants or competitions

Angel investors

Stat: 60% of UK startups that fail cite running out of cash as a key reason—figuring out early funding sources is critical. (Nerdwallet UK)

If you can build traction first, money becomes easier to raise. Investors don’t fund ideas—they fund momentum.

This post is based on insights from the MIT course “Nuts and Bolts of New Ventures.” You can watch the full session here for even more lessons.

RARE FOUNDERS EVENTS🔥

Rare Founders

Startup Run

Bi-weekly 5k running events for anyone in the startup ecosystem, followed by networking drinks in the nearby pub. Same time same, place.

In-person event

Green Park, London, W1J 9DZ, UK

Thu 6 Mar, 18:00 - 21:00 GMT

Rare Founders

London’s Largest Demo Day

100 pre-selected founders will get on stage to pitch to the audience of hundreds of investors. Join 30+ founders who secured funding at the last demo day in Oct.

Tickets to attend are FREE. Help us to rate the applicants to secure your ticket.

In-person event

1 Wimpole Street, Westminster, London, W1G 0AE, UK

Mon 14 Apr, 9:00 - 17:00 GMT

HubSpot is your ticket to a single source of truth for your sales, marketing, and customer service. Through HubSpot for Startups, you can access exclusive education, resources and software at a startup-friendly price of up to 75% off by applying here.

Want to get exposure to 8K+ readers of our newsletter? Click here.

OTHER LONDON EVENTS🌟

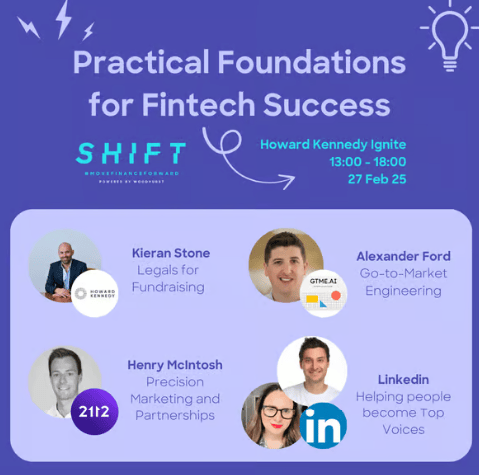

SHIFT

Fintech Foundations

Join this event for an insightful afternoon dedicated to building the essential foundations for fintech success.

Take part in four engaging roundtable discussions led by industry experts, designed to provide your business with the tools and strategies it needs to thrive.

In-person event

1 London Bridge, London, SE1 9BG, UK

Thu 27 Feb, 13:00 - 18:00 GMT

Pride in Tech

Queer AI: Bias in the Binary

Will tech define the future of LGBTQIA+ advocacy? It’s time to keep a queer eye on AI. Join this panel discussion on what’s next for queer inclusivity in AI.

In-person event

154-158 Shoreditch High Street, London, E1 6HU, UK

Thu 27 Feb, 18:00 - 21:00 GMT

Building Companies

Dyslexics Building Companies

Join this first ever Dyslexics Building Companies event for some networking.

In-person event

The Stables, 28 Britannia St, London WC1X 9JF, UK

Thu 27 Feb, 18:30 - 21:00 GMT

Founders Capital

The Future of Venture Capital: Investing in a World Transformed by AI

This panel discussion will bring together leading voices from the worlds of venture capital, AI, and entrepreneurship to explore how the rise of AI is redefining the investment landscape.

In-person event

Charing Cross area, London, UK

Thu 27 Feb, 18:30 - 22:00 GMT

Enterprise Nation

Lunch and Learn: Smart ways to save time and stay focused

In this session, Andy Wilson, senior director of new product solutions at Dropbox, will share tools and advice that save him time and help him work more productively.

He'll showcase real examples of AI tools that streamline working processes and free up time for strategic, creative tasks that keep teams engaged.

Online event

Tue 4 Mar, 12:00 - 12:30 GMT

Love Ventures

London Live

Join this exclusive investor community event.

This is a chance to catch up with the Love Ventures team and advisors, as well as fellow investors and founders of companies who Love Ventures have invested in.

In-person event

213 Oxford St, London W1D 2LG, UK

Tue 4 Mar, 18:00 - 21:30 GMT

NoBa Capital

NoBa Connect

Whether you're a founder, investor, passionate about entrepreneurship or the future of work sector more broadly, this is your chance to connect, learn, and build meaningful collaborations over drinks and nibbles.

In-person event

Moorgate area, London, UK

Wed 5 Mar, 18:30 - 21:00 GMT

Oasis London

The CFO’s perspective - The Do’s and Don’ts of Early Stage Finance

Join this event to learn on all things startup finance related. From “When you should bring on a CFO and why” to “The difference - and cost - between equity and debt.”

In-person event

60 Strand, London WC2N 5LR, UK

Wed 5 Mar, 12:00 - 13:00 GMT

Venus Global Finance

Women in FinTech Meet Up

Calling all women in FinTech and Finance! Join this event to celebrate International Women's Day and look ahead to 2025.

In-person event

Bank station area, London, UK

Wed 5 Mar, 18:00 - 20:00 GMT

Rare Founders - building the bridge between founders and investors via regular in-person and online events, meetups, conferences.